Table of contents

- 1) HODL (Hold On for Dear Life)

- 2) Fear, Uncertainty, and Doubt (FUD)

- 3) Fear Of Missing Out (FOMO)

- 4) Mooning

- 5) Decentralized Finance (DeFi)

- 6) Decentralized Applications (DApps)

- 7) Initial Coin Offering (ICO)

- 8) Gas

- 9) Hot Wallet

- 10) Peer-to-Peer

- 11) Smart Contract

- 12) All-Time High (ATH)

- 13) All-Time Low (ATL)

- 14) Proof of Stake (POS)

- 15) Whale

- Tools for Making Better Decisions

Table of contents

- 1) HODL (Hold On for Dear Life)

- 2) Fear, Uncertainty, and Doubt (FUD)

- 3) Fear Of Missing Out (FOMO)

- 4) Mooning

- 5) Decentralized Finance (DeFi)

- 6) Decentralized Applications (DApps)

- 7) Initial Coin Offering (ICO)

- 8) Gas

- 9) Hot Wallet

- 10) Peer-to-Peer

- 11) Smart Contract

- 12) All-Time High (ATH)

- 13) All-Time Low (ATL)

- 14) Proof of Stake (POS)

- 15) Whale

- Tools for Making Better Decisions

Below are some of the most important crypto terms all crypto users must know to navigate the crypto space.

With all of the complexities involved, many terms used in the crypto and blockchain space may seem alien to newcomers. However, to understand and make better decisions about trading crypto or participating in the blockchain sector, members of the community must understand these terms. The following are some of the most important ones everyone needs to know.

1) HODL (Hold On for Dear Life)

HODL is one of the most basic and essential terms in crypto, originally derived from a misspelling of "hold" on a Bitcoin forum. The idea here is that crypto users with a particular asset in their portfolios hold it for the long term, regardless of short-term market trends. HODL originally came up in a post on the BitcoinTalk forum in 2013 as a spelling mistake made by a user in a post titled: "I AM HODLING."

2) Fear, Uncertainty, and Doubt (FUD)

FUD is a common tactic used in crypto to manipulate the perception of a crypto asset or the entire cryptocurrency market by spreading false or misleading information. FUD can significantly drop the price of the targeted crypto asset or several assets simultaneously. Common examples are media platforms' suggestions that crypto is a fad or rumors that governments will ban cryptocurrencies entirely.

3) Fear Of Missing Out (FOMO)

FOMO is the emotion that crypto enthusiasts and traders feel when they flock to buy an asset for fear of missing out on a potentially profitable opportunity. As heavy emotions are involved, FOMO can spike an asset's price and cause it to quickly reach significant highs. Unfortunately, this often leads to an asset bubble popping and may result in more damage to the buyers if the asset's price crashes.

4) Mooning

"Mooning" means that a crypto asset's valuation is figuratively 'going to the moon' by experiencing a significant increase in price and volume in a relatively short amount of time. During such occurrences, crypto traders attempt to determine the best time to sell their crypto assets to get the best possible price.

5) Decentralized Finance (DeFi)

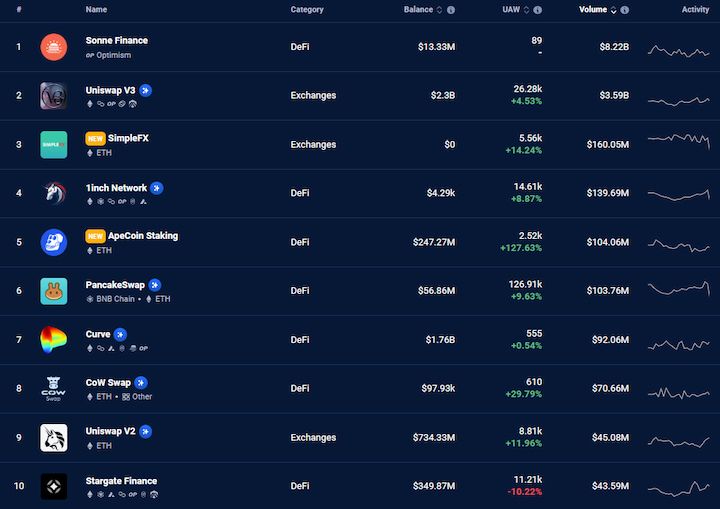

DeFi is a blanket term used to describe decentralized finance tools, protocols, and platforms people use to manage funds without depending on any centralized, traditional financial infrastructures like banks or government-issued currencies. It is a novel monetary system that gives users complete control over their funds by providing access to essential financial services without centralization. DeFi relies on open and transparent smart contract platforms like Ethereum.

6) Decentralized Applications (DApps)

A decentralized application (DApp) is a software application built and run on a set of rules outlined using smart contracts on a distributed blockchain network. Like any other software application, developers design DApps to perform various tasks and provide a wide range of services. For instance, there are DApps designed as games, financial solutions, logistics, and many other real-world applications.

7) Initial Coin Offering (ICO)

An initial coin offering (ICO) is a fundraising method used by startups to raise capital for their early-stage crypto projects. These projects are crowdfunded by creating and selling digital tokens related to the project's blockchain ecosystem. The tokens may represent a stake in the company or have utility related to the product.

Crypto-based startups raising capital through an ICO do so by minting a certain amount of their native crypto asset and issuing them for sale to early buyers.

8) Gas

Gas is the platform transaction fee on blockchains like Bitcoin or the Ethereum network. Ethereum users utilizing smart contracts or launching DApps (decentralized applications) pay gas fees in ETH, along with users performing simple transactions. The Ethereum blockchain introduced gas fees to pay miners for securing and verifying the network. The network has also made it the reward for staking ETH and participating in validation.

9) Hot Wallet

A hot wallet is a digital wallet that performs blockchain transactions while remaining connected to the internet. Also known as software wallets, hot wallets are software applications or browser extensions that facilitate sending, receiving, and storing crypto. Hot wallets are available in three categories: desktop, online (or web), and mobile. Although they make crypto trading convenient, hot wallets are more vulnerable to cyber-attacks or malicious acts than cold wallets.

10) Peer-to-Peer

Peer-to-Peer (P2P) is a term used to describe a form of digital communication between two or more parties without a third-party or centralized participant facilitating it. P2P services use these interaction techniques to complete tasks between users that are involved in a network. Also, P2P transactions require nodes to share resources and computational power with others and create a consensus between parties.

11) Smart Contract

Smart contracts are self-executing programs that run on many blockchain networks, like Ethereum, enabling developers to set specific conditions a transaction must meet before final execution. They are enforceable agreements between participants, finalized in open-source code and recorded on a decentralized ledger distributed across the Ethereum network. Smart contracts are immutable and transparent for all participants.

12) All-Time High (ATH)

An all-time high is the highest recorded price of a crypto asset. Crypto traders use this term to indicate the highest price realized by a digital asset on a specific crypto exchange or throughout the broader market. Most crypto assets record an all-time high during a bull market when the general prices of cryptocurrencies on markets and exchanges are in an uptrend.

13) All-Time Low (ATL)

The direct inverse of an asset's ATH is its all-time low (ATL). This is the lowest price a crypto asset has recorded since its launch. For most crypto assets, an ATL occurs when there is negative news about the asset for extended periods or when holders begin to sell off their holdings. In most cases, all-time lows indicate the beginning of a crypto bear market and usually result in more price drops.

14) Proof of Stake (POS)

Proof of stake (POS) is a consensus algorithm that facilitates the safe and reliable verification of blockchain transactions through token staking. The POS mechanism requires users to "stake" their assets on the network for eligibility to verify blocks of transactions. In POS, validators are responsible for creating and verifying blocks. The more assets someone stakes, the more likely they are selected as a validator, and the more likely they will be rewarded for validation.

15) Whale

Crypto whales are individuals or entities that own large amounts of a particular asset. Generally, the considerable quantity of a specific asset held by crypto whales gives them the power to significantly influence market prices by trading large amounts of a particular coin or token. Additionally, whales can significantly impact proof-of-stake (POS) networks, as larger quantities of staked assets lead to more voting power within the ecosystem.

Tools for Making Better Decisions

The crypto market's extreme volatility makes it difficult for newbies and experienced users to make the best trading decisions. Understanding terms commonly used in the space will help enthusiasts digest news stories, recognize trends, and make better choices.