Table of contents

Synthetix is an Ethereum-based protocol for creating synthetic assets that track real-world assets.

Like the crypto industry, the traditional financial sector also has various products that people trade or hold, hoping to earn a profit as value rises. In the past, these assets and products were only available through centralized entities. However, with the emergence of blockchain tech, there are now protocols that provide access to such assets and other financial products as synthetic crypto tokens. An example of this type of protocol is the Ethereum-based Synthetix network.

What Is Synthetix?

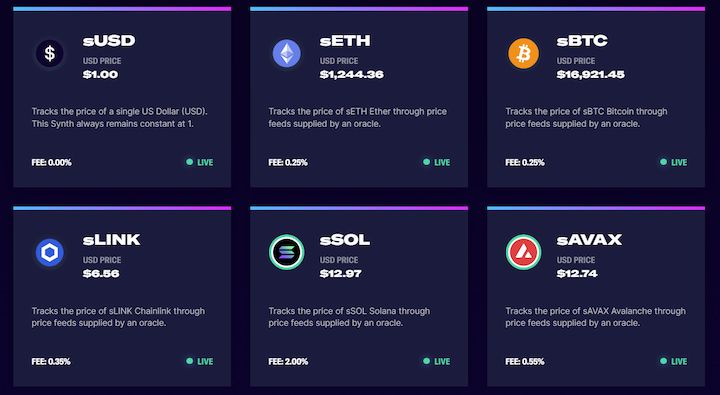

Synthetix is a derivatives liquidity protocol built on the Ethereum blockchain, enabling users to trade derivatives in the DeFi space. The protocol facilitates the minting and trading of synthetic assets from the traditional and crypto-based sectors. These synthetic assets are called Synths, and can track and hold the values of any real-world asset, such as fiat currencies like the US dollar, crypto assets like Ether or Bitcoin, or precious metals like gold and silver. The protocol also enables users to trade inverse Synths that maintain an inverse relationship with the underlying asset.

The main goal of the Synthetix protocol is to enable its users to trade a wide range of financial products and assets that do not exist on-chain. Additionally, users of the Synthetix protocol can create indexes such as the DeFi index, which tracks the prices of multiple DeFi assets.

What is Synthetix Network Token (SNX)?

SNX is one of two tokens that run the Synthetix protocol. The SNX token functions as collateral when minting synthetic tokens as ERC-20 smart contracts. SNX holders can also choose to stake their tokens to earn interest. In addition, SNX serves as a governance token that enables users to vote on proposals and nominate candidates for the decentralized autonomous organizations (DAOs) that govern the protocol.

History of Synthetix Network Token

Synthetix is the brainchild of Cain Warwick. In addition to being the Synthetix protocol’s founder, Warwick also plays key roles in several firms within and outside the blockchain sector. Warwick is an advisory board member at The Burger Collective, an Advisory Council Member of Blockchain Australia, and Founder / Non-Executive Director of Blueshyft.

At its launch in 2017, the network raised $30m through its Initial Coin Offering (ICO) and the sale of its native token SNX. Subsequently, in 2018, the network minted its first Synth.

Two other key members of the Synthetix core team are Justin Moses and Clinton Ennis. Since launch, Justin Moses has been Synthetix’s CTO and was MongoDB’s Director of Engineering before Synthetix. Clint Ennis is Synthetix’s Senior Architect and has over 18 years of experience in software engineering. Before his move to Synthetix, Ennis worked as an Architect Lead at JPMorgan Chase.

How Does Synthetix Work?

The Synthetix network relies on two tokens to function: SNX and Synths. The protocol operates using various mechanisms, including fees, inflation, collateral, and staking. To ensure the accuracy of synthetic asset prices, Synthetix uses Chainlink’s decentralized oracles. These oracles provide real-time, accurate market data and are impossible to manipulate. The accuracy of market data received further ensures that all the synthetic assets have correspondingly correct values.

For better-decentralized control of the protocol, the network operates three different DAOs, each with unique responsibilities:

- Synthetix DAO: Controls funding for those who participate in network advancement

- Grants DAO: Controls community proposal funding for public goods on Synthetix

- Protocol DAO: Controls funding for developing smart contracts and protocol updates

Governance on Synthetix happens in two ways: SIP (Synthetix Improvement Proposals) and SCCP (Synthetix Configuration Change Proposals). SNX holders use SIP to make protocol improvement proposals, while SCCP shows all the proposed changes for the protocol.

When someone creates a proposal, the governing DAO discusses SIPs through interviews. Then, after thoroughly evaluating all the implications of a proposal, they either deny or accept it.

What Makes Synthetix Token Unique?

There are many reasons why the Synthetix protocol is unique. The protocol’s primary aim of exposing users to various assets via Synths - without actually holding the underlying asset - is a major selling point.

Another notable feature is the ability for any user to easily convert Synths without a counterparty. Users can trade one Synth for any other on the Synthetix DEX.

Furthermore, the Synthetix protocol provides peer-to-contract (P2C) trading. P2C trades are quickly and easily executed without any order book. A distributed pool of token holders makes P2C trading possible as it provides the required collateral on the platform and maintains the entire network’s stability.

Additionally, using smart contracts to track underlying asset prices allows users to trade synths seamlessly without liquidity or slippage issues. This also eliminates the need for any third parties. One of the most notable milestones in Synthetix’s growth was its shift to Optimism, a layer two scaling solution built on top of Ethereum. This move meant a significant drop in gas prices and improved scalability.

How Is The Synthetix Network Token Backed?

New Synths minted by users become part of the network’s debt pool. The total value of the debt pool is equal to the total value of all Synths minted on the network. The Synthetix protocol backs its value through over-collateralization. This means that each synthetic asset gets collateralized by more value than it represents. The Synthetix network requires a collateral rate of 750%, meaning that if a user wants to mint 1000 sUSD (synthetic USD), they must deposit $7500.

Users create Synths by staking SNX as collateral and minting a synthetic asset against it. Hence, each minted Synth is a debt against the staked collateral. Synthetix requires each user to maintain a certain collateralization ratio (C-ratio) determined by the platform’s governance system. The aim is to ensure that all Synths on the network are sufficiently collateralized and there is no deficit, even during the market’s most volatile periods.

New Opportunities With SNX

SNX is a promising token that drives a very versatile DeFi protocol. Minting Synths is a great way to securely trade the value of real-world assets and crypto assets in the blockchain space. The protocol allows users to capitalize on asset volatility without owning any of the underlying assets. The Synthetix protocol is one of the oldest DeFi platforms that maintains a decentralized governance structure through its Synthetix DAO. Since its launch, Synthetix’s functionality, available features, and adoption rate have all grown, especially since its Optimism layer two implementation.