06 October 2022

Updated: 03 February 2023

What Is Solana (SOL)? — Scalable Smart Contract Platform

Table of contents

Given Solana's significance within the cryptosphere, it’s worth knowing more about a network that could have immense potential for DeFi, NFTs, and Web3 in general.

The past few years have seen several new blockchain networks appear, each with its own take on how to best create and facilitate a decentralized smart contract network. These have led to a sort of arms race — in the most pacifist way possible — between competing networks, with each trying to outdo the other with technical designs and implementations. One such network is Solana, frequently making headlines across 2022, and has often been touted as a significant competitor to Ethereum.

What Is Solana?

On the face of it, Solana is simply a public blockchain network that allows smart contracts to run on it. This is much like Ethereum, but the devil is in the details, and Solana’s design of a single network that permits high throughput with low fees is what is stirring up headlines.

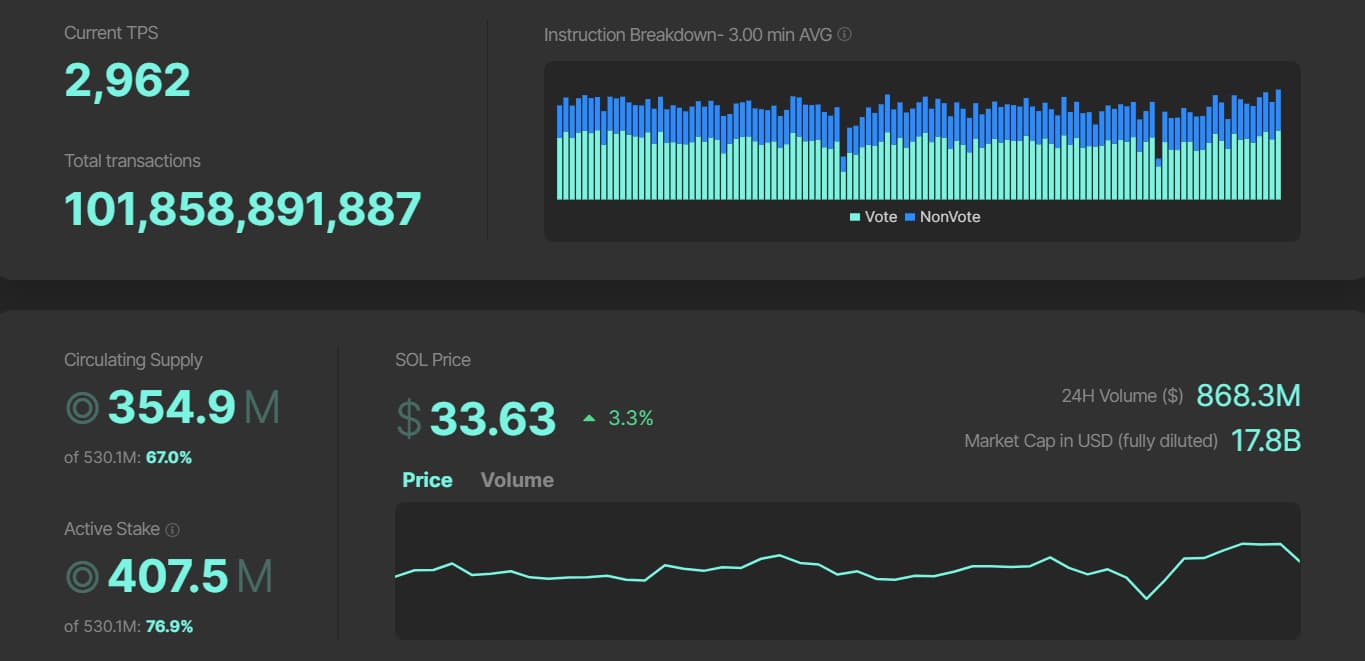

Solana calls itself the fastest blockchain in the world, a claim that some other Ethereum competitors may want to challenge, but it’s certainly high up there in terms of scalability. At present, the Solana blockchain has a transaction rate of approximately 2,700 transactions per second at an average transaction cost of $0.00025. The potential throughput lies at a whopping 50,000 transactions per second, far surpassing most available decentralized smart contract networks. For example, this is magnitudes higher than Ethereum, which has a transaction rate of 10–15 transactions per second at gas fees that can often exceed $200-$300+.

Solana was conceived in late 2017 by Anatoly Yakovenko, who designed a new mechanism that would result in much better network performance than previous distributed ledger iterations. His discovery allowed for automatically ordered transactions, rapid settlement times, and compatibility with all LLVM smart contract languages.

But there was a long period between its initial conception and its mainnet beta launch, which occurred in Q1 2020. In that intervening period, it saw multiple fundraising rounds, with investors including some of the biggest in the ecosystem, such as Andreessen Horowitz, Polychain Capital, Alameda Research, and CoinShares. Of course, all of this has led to people googling such things as “Solana coin price” or “Solana crypto price.” That’s unsurprising, given how much of a buzz the project is creating.

But why all the buzz in the first place?

Solana’s Core Features

The block generation mechanism is where Solana primarily differs from Ethereum and others, and is what permits such a high transaction throughput.

Proof-of-History

Solana uses a combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) to achieve its capabilities. The latter secures the network, while PoH tracks the time between computers communicating on the network without the nodes on the networks having to agree on it.

The PoH mechanism does this by creating a record of when an event occurs at a specific time. Leader nodes timestamp blocks with cryptographic proofs into the blocks, which are shared with other nodes. These blocks can be delivered in any order — hence the automatically rendered transactions and faster speeds.

PoS itself is the consensus mechanism, but PoH improves its performance considerably — with block times being about 400 milliseconds per block. This is Solana’s most distinguishing feature, and as we shall see, is what bolsters its purpose of being a new broadly accepted ecosystem for dApps.

Tower BFT

Solana uses a customized version of Practical Byzantine Fault Tolerance (PBFT) for its PoH mechanism. This is quite a technical matter, so we won’t go over the nitty-gritty details. The long and short of it is that it is asynchronous and reduces overhead and latency.

Gulf Stream

Another core feature of Solana is Gulf Stream, which is a mempool-less transaction forwarding protocol. Mempools are transactions that have been submitted but not yet processed. Solana’s validators can manage mempools of up to 100,000 transactions, another major contributor to the high throughput.

Turbine

Turbine helps transmit data quickly among peers. Typically, a leading validator would have to transmit data to all of the other validators. With Turbine, the leader has blocks that break up into smaller sizes, with each packet transmitted to a different validator. The latter then retransmits the package. This is somewhat similar to the BitTorrent system.

What Purpose Does Solana Serve?

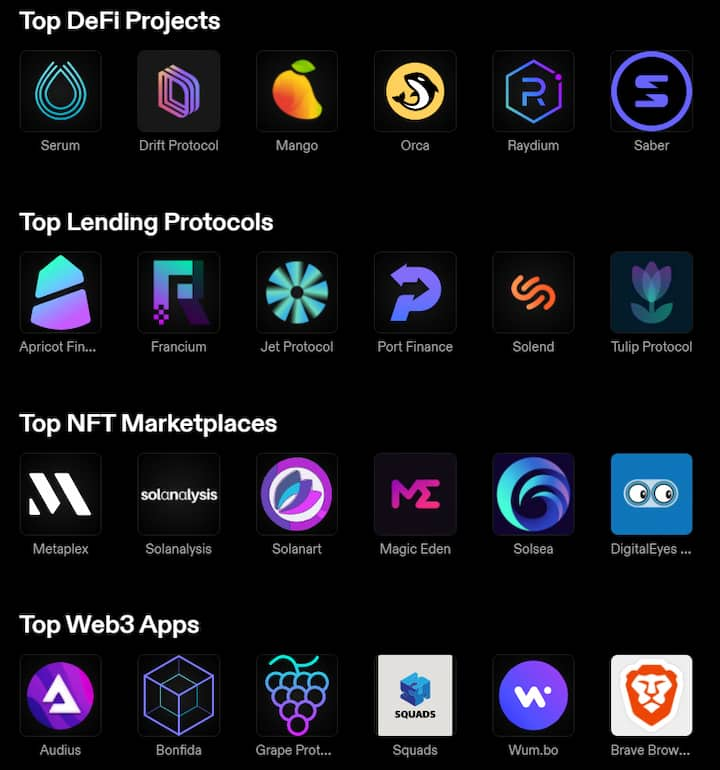

Solana’s purpose is simple: offer a high-performance blockchain for decentralized applications. In this regard, too, it is similar to Ethereum and all of its competitors. Taking a quick glance at Solana’s top dApps shows decentralized exchange and crypto lending apps leading usage, with many other up-and-coming apps following in their paths.

Solana has already forayed deep into DeFi, DEXs, and NFTs — all of which are some of the cornerstones of the Ethereum ecosystem. But, with its higher performance and lower transaction costs, Solana is theoretically a more viable solution for the dApp ecosystem in some respects.

What Does Solana’s Future Look Like?

The emphasis is on the word theoretically, because Ethereum itself is working on scaling solutions, some of which already exist in the form of Polygon Network, amongst other scaling functionalities. There are also many other competing networks that boast high throughput and low costs, like Fantom and Binance Smart Chain, making it that much harder for Solana to separate from the rest of the pack.

Solana’s future isn’t guaranteed to be a glorious one simply because of the number of networks it is competing with, not the least of which is Ethereum, which has a tremendous head start when it comes to ecosystem development, users, and total value locked (TVL).

The real decider will be the dApp ecosystem itself, and it is only now that Solana is beginning to see an influx of developers. Currently, NFTs appear to be a central focus within the Solana ecosystem, which is unsurprising given how much attention they are receiving from the general public.

Solana isn’t quite in its full mainnet mode yet — it’s still in its mainnet beta phase. For all intents and purposes, it functions as the actual full mainnet release, but perhaps the development team has changes planned. There has been no date on this release, but the focus now is on stability and general fixes.

How Does Staking Work With Solana?

All you need to do to stake the Solana coin is have a compatible wallet. The Solana crypto wallet itself will guide you through the staking process, helping you create a staking account along the way. Compatible wallets include Ledger Nano, Exodus wallet, and the Binance and FTX exchanges.

You will be rewarded for securing the network. Should the Solana price increase, you could potentially find yourself making good returns as you earn tokens over time.

Of course, you need to know where to buy Solana (SOL). The cryptocurrency can be found on several platforms, including Binance, FTX, Kraken, Coinbase, and other popular exchanges.

Long Road Lies Ahead

The near future sees strong ambitions for the Solana crypto project. Yakovenko has said that the aim is to onboard one billion users, but that’s an ambitious goal considering the competition from other networks. Still, as far as network performance goes, Solana is looking strong and has more than a fighting chance to at least become the home to a few dApps that can make it big.

There’s no reason to think that Solana, Ethereum, and others can’t coexist either. It may very well end up being the case that we get multiple high-performance networks, each with their own unique native dApps that can work with each other via interoperability solutions.

Hold and Trade SOL On AtomicDEX

AtomicDEX is a non-custodial multi-coin wallet and atomic swap DEX. Store Solana as well as Bitcoin, Dogecoin, Dash, Qtum and many other coins in your own wallet. When you're ready to trade, AtomicDEX supports cross-chain swaps. Your keys, your coins.