12 October 2022

Updated: 24 November 2022

Hot Wallets vs. Cold Wallets: Which Wallet Type Is For You?

Table of contents

Holding crypto requires users to store funds in a crypto wallet. Wallets give users easy access to their stored cryptocurrencies by generating public addresses and private keys that provide user-friendly access to the blockchain.

There are two main types of wallets: hot and cold. Essentially, a hot wallet is any wallet that is connected to the internet, and a cold wallet is any wallet that isn't connected to the internet.

Let's further examine how both types compare and contrast.

What Are Crypto Hot Wallets?

A hot wallet is a crypto wallet that is connected to the internet. Hot wallets are programs or browser extensions that facilitate crypto storage and transfers.

Pros and Cons of Hot Wallets

How Do Hot Wallets Work?

A hot wallet is any crypto wallet that requires an internet connection for access. Simply put, hot wallets are “online.” When a user creates a hot wallet, the platform assigns private keys and public addresses for cryptocurrencies.

Public addresses are similar to account numbers as they identify the wallet so that the user can receive funds from anyone. On the other hand, a private key is like a PIN or password that enables users to access their funds and facilitate transactions. With hot wallets, private keys and public addresses are available online and accessible via internet-enabled devices.

Who Hot Wallets May Be Suitable For

Since hot wallets are easily accessible over the internet, these wallets are suitable for crypto investors who carry out frequent transactions. Hot wallets are also ideal for people who don’t hold large amounts of crypto and are comfortable keeping their assets on crypto exchanges. These wallets are better for regular transactions and not for storing large amounts.

How to Keep Your Hot Wallet Secure

The most efficient way to keep hot wallets secure is by using an easy-to-remember password and memorizing it. Users may also keep hot wallet funds safe by minimizing the amount of assets stored in them, since hot wallets that hold large amounts of crypto may be more susceptible to attacks. Users with large crypto portfolios usually prefer to hold most of their assets in cold wallets and keep funds required for day-to-day transactions in hot wallets.

What are Cold Wallets?

A cold wallet is a digital wallet disconnected from the internet and is the safest option for long-term crypto holding. Since cold wallets do not primarily require an internet connection and never expose private keys online, crypto owners can carry their wallets around and only risk a loss when they damage or lose the physical device or item holding the funds. Furthermore, even if the device is lost, users can regain access to crypto assets via a seed phrase or private key.

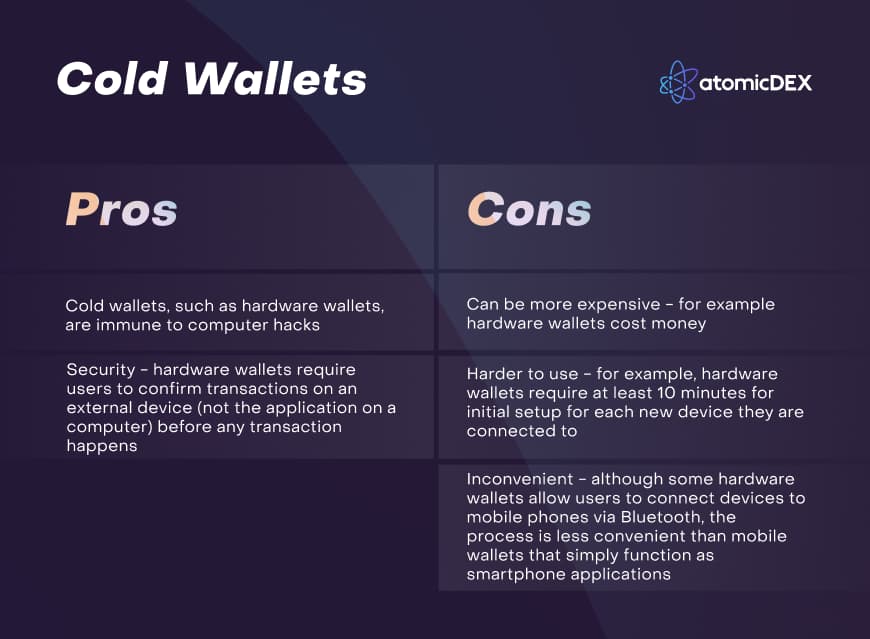

Pros and Cons of Cold Wallets

How Do Cold Wallets Work?

Cold wallets are offline crypto wallets that can store your private keys in a secure environment.

Asset transfers using a cold wallet use an offline device (e.g. hardware wallet) for authorization. Once completed, the wallet sends data online to update the network.

Who Cold Wallets May Be Suitable For

Cold wallets are ideal for crypto HODLers with large amounts of digital assets in their portfolios. This type of wallet is also suitable for crypto whales or other investors that prefer to keep assets for a long time instead of day trading.

How to Keep Your Cold Wallet Secured

The safest way is to write your private keys or seed phrases down on a piece of paper, creating a paper wallet as a backup. Users with hardware wallets or paper wallets must store devices in safe places where there is no risk of physical damage.

Many users laminate their paper wallets and store them in safety deposit boxes at banks or safes in their homes. To prevent asset loss, users should also ensure that keys are not easily accessible by third parties.

Which Wallet Type Is Better?

Understanding the different types of cryptocurrency wallets is essential for building a crypto portfolio. At the same time, the security of funds is a vital concern to users looking for the best crypto wallets that suit their needs.

In summary, using a hot wallet is more convenient for frequent and small transactions. Meanwhile, using a cold wallet is better for users who plan to HODL large amounts of crypto and make only sparing transactions.

Try AtomicDEX — Multicoin Wallet with a Built-in Decentralized Exchange

AtomicDEX is a non-custodial multicoin DEX wallet, cross-chain/protocol bridge, cross-chain/protocol decentralized exchange rolled into one app. Use AtomicDEX as a hot wallet for storing cryptocurrencies. Use the built-in DEX to trade across multiple blockchains. BTC, ETH and ERC-20 tokens, BNB, AVAX, MATIC, KMD, and many more cryptocurrencies are supported.