Table of contents

The services offered by the financial sector have evolved over the years, with the emergence of blockchain technology and decentralized finance providing new ways for all to participate without barriers.

In the past, financial services such as fund transfers, loans, and insurance policies were only offered by conventional financial institutions to individuals they deemed worthy. Smaller organizations without heavy cash reserves couldn't provide these services to applicants that didn't meet eligibility requirements or were otherwise denied.

Since the emergence of blockchain technology and cryptocurrencies, the financial sector has significantly transformed, and can now cater to needs not easily met by conventional institutions.

These new blockchain projects offer centralized finance (CeFi) or decentralized finance (DeFi) services. While both crypto concepts try to simplify access to virtual currencies, their methods are fundamentally different.

DeFi Vs. CeFi: A Quick Summary

What Is CeFi and How Does It Work?

Centralized finance (CeFi) refers to closed financial markets where transactions go through a centralized system. Traditional financial institutions operate as centralized authorities as they process payments, withdrawals, deposits, loans, and other financial transactions through a single governing entity.

Many major crypto exchanges are centralized, as they must adhere to anti-money laundering (AML) and know your customer (KYC) requirements before allowing cryptocurrency trading and other transactions for end users. In addition, CeFi platforms require that customers use custodial wallets for storage and don't give users full control over their private keys.

Users of centralized platforms don't have absolute authority over their crypto assets. Each person must also play by the platform's rules on withdrawals restrictions and trading volumes. Examples of centralized crypto exchanges are Binance, Coinbase, and Kraken.

CeFi Pros and Cons

CeFi establishes trust among users by ensuring asset safety and seamless trading. However, while it provides several advantages, there are also downsides to centralized finance. Below are a few pros and cons:

CeFi Pros

- CeFi platforms can provide highly intuitive and user-friendly features based on their history and experience.

- Users can enjoy a broader range of traditional financial services, such as support for direct fiat currency transactions.

- Custodial solutions are available so that new crypto users don't have to personally worry about managing mnemonic phrases to keep their funds safe.

CeFi Cons

- CeFi platforms operate differently and provide varying levels of asset security. Users must conduct exhaustive research on each platform before moving forward with any deposits or use.

- Unlike conventional bank savings, most crypto deposits have no government insurance against loss.

- CeFi transaction fees are relatively high.

- Centralized platforms may apply hidden charges to particular transactions.

- There is a well-known lack of transparency rampant among CeFi projects.

- Interest rates on stored assets are usually low.

- CeFi platforms have complete control over your funds, meaning if you don't satisfy all of their requirements, they could potentially freeze your funds.

What Is DeFi and How Does It Work?

Decentralized finance, or more specifically DeFi 2.0, focuses on building financial solutions and services using publicly viewable ledgers and smart contracts without intermediaries.

Traditional financial institutions act as transaction guarantors in the financial sector. Since funds pass through these institutions, they greatly influence financial activities. The DeFi system improves this method by replacing go-betweens with smart contracts, essentially fine-tuning traditional financial services with blockchain technology.

Decentralized crypto exchanges (DEXs) are currently the most common DeFi application. Crypto enthusiasts seeking autonomy usually prefer DEXs because of the control these platforms provide to their users. Examples of decentralized exchanges are Uniswap, PancakeSwap, and AtomicDEX.

The DeFi ecosystem has evolved over the years, from simple cryptocurrency trading to a few other financial services. Features available to users include:

- Lending platforms

- Decentralized autonomous organizations (DAOs)

- Prediction markets

- Yield farming

- Insurance

- Borrowing

- DeFi margin trading

CeFi vs. DeFi: The Similarities

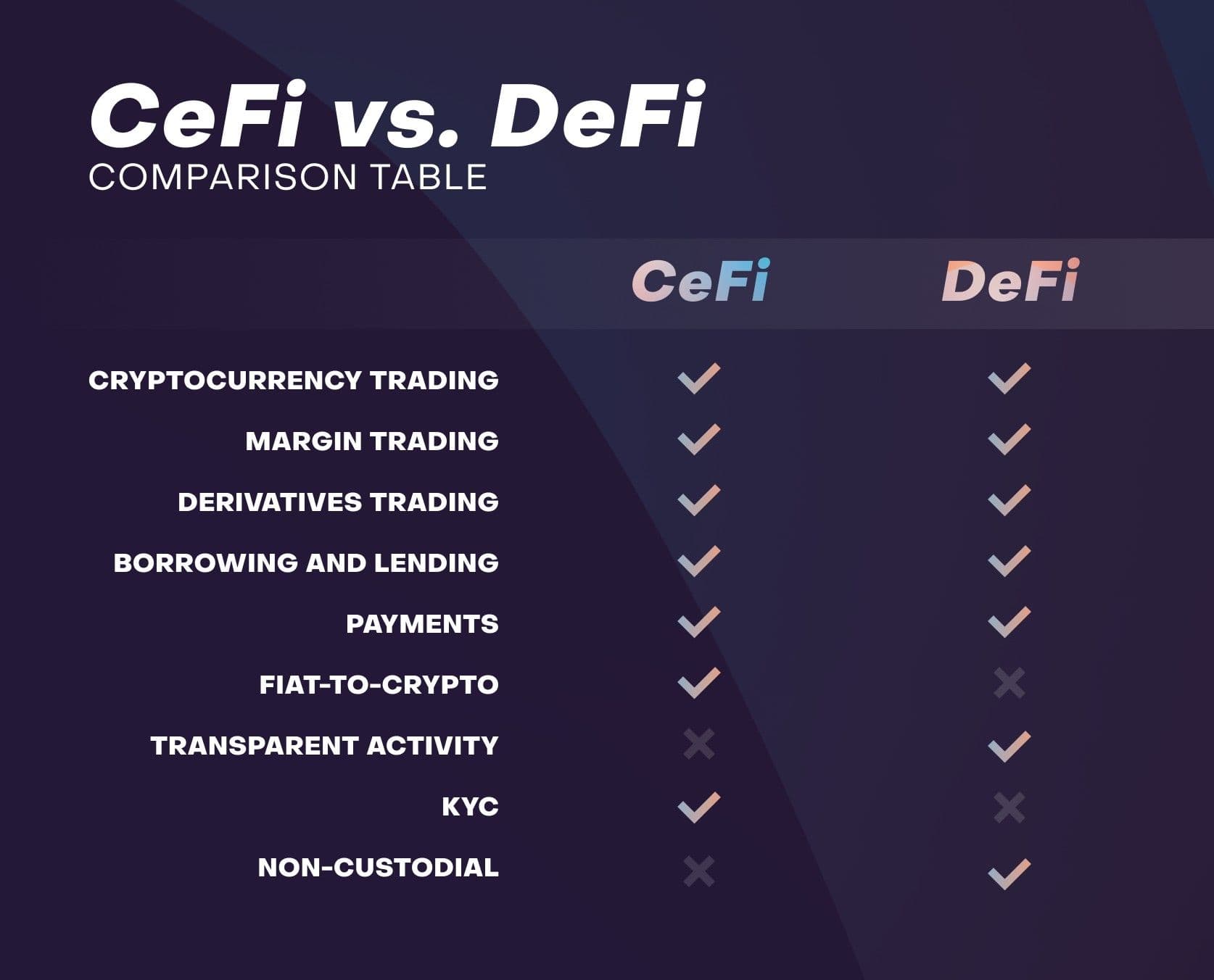

DeFi and CeFi share several similarities because, in many cases, they provide the same financial solutions and services. Customers interested in spot trading, margin trading, access to futures and derivatives, as well as borrowing and crypto lending, can enjoy these services from centralized and decentralized platforms alike. Both concepts generally advocate the use and adoption of digital assets and blockchain technology.

CeFi vs. DeFi: The Differences

Even though they share a fundamental aim to promote the adoption of decentralized ledger technologies (DLTs), several significant differences split DeFi and CeFi. The following are a few examples:

- Public Verifiability — All DeFi execution and bytecode must be publicly verifiable on a blockchain to qualify as non-custodial. Unlike centralized finance, any DeFi user can monitor and verify transactions and changes to the blockchain, as it all takes place on-chain.

- Custody — In CeFi, all exchanges are custodial and have primary control of stored assets. On the other hand, DeFi gives users have complete control of their crypto assets through non-custodial wallets like the AtomicDEX wallet. Users are also responsible for the safety of their funds, taking the power away from centralized authorities.

- Crypto Trading — Centralized exchanges (CEXs) rely on the same principles as their conventional counterparts. CEXs use order books, which are off-chain records of orders carried out by traders. Instead of an order book, a decentralized exchange (DEX) works by matching transactions using peer-to-peer (P2P) or automated market maker (AMM) protocols.

- Transaction Costs — The DeFi ecosystem uses transaction fees to mitigate spam activity by putting a cost on each transaction. With CeFi, the presence of AML and KYC verifications reduces the risk of spam transactions, allowing centralized financial institutions to sometimes offer lower transaction fees.

- Fiat Conversion Flexibility — CeFi services are flexible and allow users to convert fiat to crypto and vice versa. Many DeFi platforms do not offer fiat deposit and conversion options because the process usually requires centralized institutions for KYC verification.

Choosing between DeFi vs. CeFi isn't necessarily an either/or choice. Both contribute to the popularity and adoption of cryptocurrency and blockchain technology. However, the inherent design of DeFi solutions provides users with the advantages of distributed ledger technology, including self-sovereignty and genuine control over all crypto assets.

Enjoy P2P DeFi with AtomicDEX

Download the AtomicDEX wallet to experience a truly decentralized finance platform.

AtomicDEX is an application for storing and trading digital assets, including BTC, ETH and all ERC-20 tokens, BNB and all BEP-20 tokens, and much more.