11 August 2022

Updated: 18 August 2022

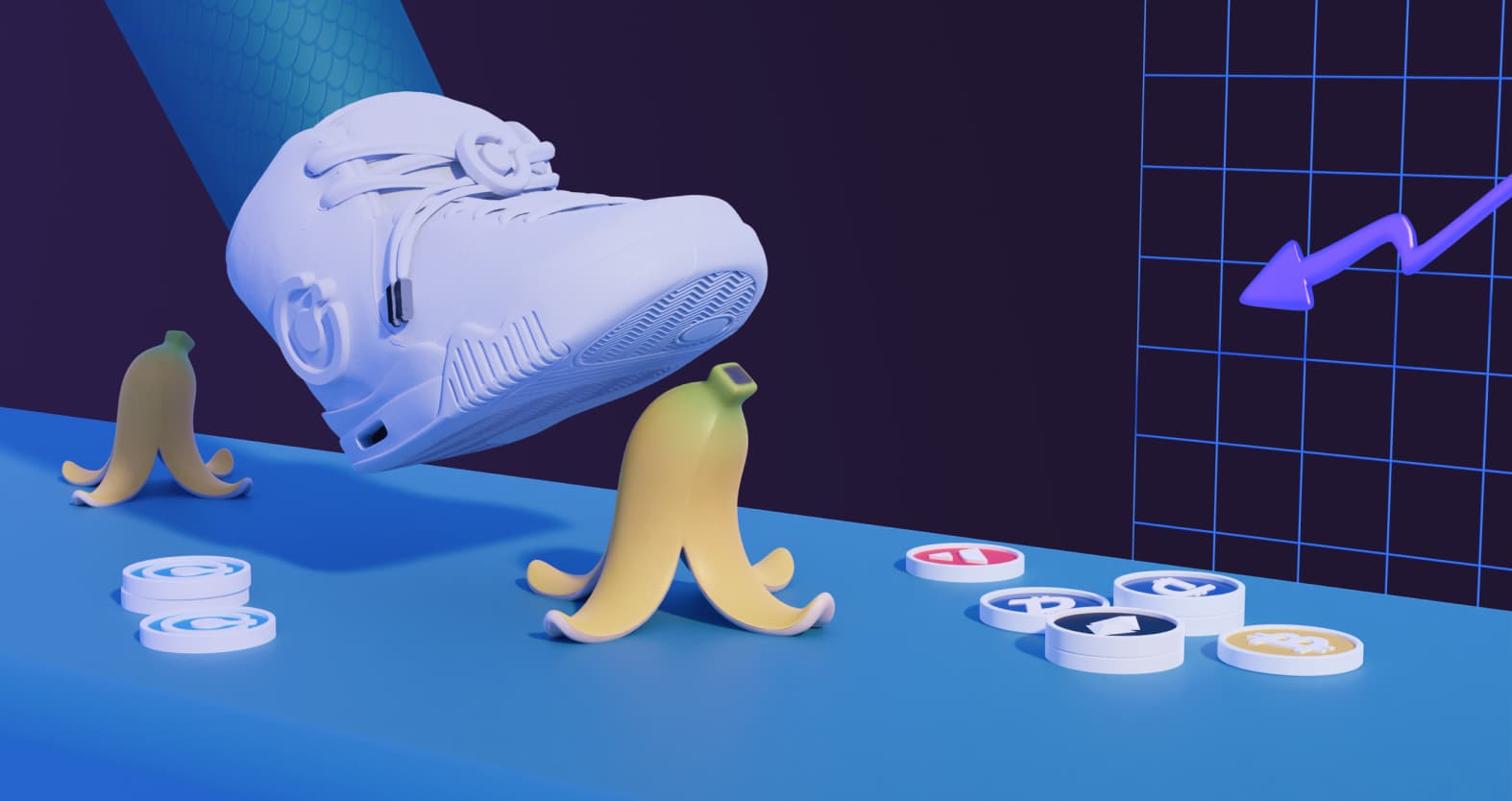

What Is Slippage in Crypto Trading and How To Avoid It?

Table of contents

- What Is Slippage in Crypto?

- The Causes of Slippage in Crypto Trading

- Types of Slippage

- How to Avoid Negative Crypto Slippage

- Placing Limit Orders

- Increase Gas on Transaction

- Use Exchanges With High Levels of Liquidity

- Trade During Active Hours

- Trade With Fast Brokers or DEX Platforms

- Slippage Tolerance

- What Is Front-running?

- Summary — Slippage and Crypto Trading

- Trade P2P on AtomicDEX

Table of contents

- What Is Slippage in Crypto?

- The Causes of Slippage in Crypto Trading

- Types of Slippage

- How to Avoid Negative Crypto Slippage

- Placing Limit Orders

- Increase Gas on Transaction

- Use Exchanges With High Levels of Liquidity

- Trade During Active Hours

- Trade With Fast Brokers or DEX Platforms

- Slippage Tolerance

- What Is Front-running?

- Summary — Slippage and Crypto Trading

- Trade P2P on AtomicDEX

Traders in the traditional financial sector always try to trade securities and stocks at the best possible prices. This means executing buy orders at the lowest possible rates and sell orders at the highest prices based on current market conditions.

While traditional markets are relatively stable, price movements in the crypto market are more rapid and can change in the short window between placing and executing orders. Depending on the tokens you're trading, there can also be low liquidity in the trading pool, which can affect the trading price of the assets. This price difference, called 'slippage,' is an essential factor crypto traders must fit into their risk tolerance and trading plans.

What Is Slippage in Crypto?

Slippage is the difference between the amount of an asset you will receive at the time the trader places the order, and the amount after the order is fulfilled. Slippage can happen when buying or selling an asset and can cause serious gains or losses. Although many traders expect order and execution prices to remain the same, slippage is nearly inevitable, especially when trading high-volatility assets.

The Causes of Slippage in Crypto Trading

Some of the causes of slippage in crypto trading include:

High or Low Demand

When many traders place buy orders for an asset, the simultaneous execution of these orders drives the asset's value. On the other hand, an asset with low demand means more active sellers than buyers. The sellers constantly drive the asset price lower as each order gets executed. In both instances, slippage becomes unavoidable as the asset's value fluctuates.

High Volatility and Instability

Since crypto asset prices are volatile, price movements between order placement and execution are unavoidable. Large orders on assets with high volatility can result in significant slippage and substantial losses or gains in very short periods.

Liquidity

Liquidity describes how quickly traders can buy or sell a crypto asset at its current market value with little or no price changes. The lower an asset's liquidity, the less likely it is quickly executed at the market price. If the order takes a long time, the probability of slippage is high.

Types of Slippage

Depending on price movements, slippage in crypto trading is either positive or negative.

Positive Slippage

Positive slippage occurs when the price of an asset falls. If the price of a volatile crypto asset drops to $80 after a trader places a buy order of 100 units at $100 each, the trader gains $2000 from a positive slippage of $20.

Negative Slippage

Negative slippage is a loss of value caused by an increase in asset prices. A trader has experienced a negative slippage of $20 if the price of an asset rises to $120 after placing the order at $100.

How to Avoid Negative Crypto Slippage

There are several ways to minimize exposure to negative slippage. Some of these include:

Placing Limit Orders

The safest way to reduce the chance of slippage is to place limit orders instead of market orders. When traders use limit orders for transactions, they can specify a maximum buy and minimum sell price for that trade. Using limit orders ensures that trades are only executed within a predefined price range.

Increase Gas on Transaction

Another way to reduce slippage is to increase the gas price on transactions. This bump in gas will ensure that transactions get processed more quickly, limiting the risks associated with price fluctuations. While this does not guarantee that trades will execute at the expected price, it helps mitigate potential losses.

Use Exchanges With High Levels of Liquidity

Traders can also avoid slippage by trading on crypto exchanges with high liquidity. Since high-liquidity exchanges have many active buyers and sellers, traders are more likely to execute transactions at expected prices.

Larger well-known crypto exchanges usually have higher liquidity than lesser-known ones.

Trade During Active Hours

The cryptocurrency market is active 24/7. However, there are certain times when trading is more active. Limiting trading activity to these peak periods increases the chance of executing an order at the expected price.

Most crypto exchanges report each asset's current and past trading volume. Traders can observe trading volume over a few days to determine the most active hours.

Trade With Fast Brokers or DEX Platforms

Traders can avoid unnecessary slippage by trading with fast-executing brokers or decentralized exchange (DEX) platforms. The less time a broker needs to process a buy or sell order, the lower the chance that the asset's price will change.

Slippage Tolerance

Slippage tolerance is a way to set the amount of slippage that a trader is willing to accept. If a trader sets a slippage dollar amount or percentage and the asset's price exceeds that, the trade is immediately rejected. This is another way traders can limit potential losses on trades.

Traders should note that the amount of slippage set can affect the time it takes for the transaction to execute. If the set slippage tolerance is too low, the order could either take too long or remain unfulfilled. On the other hand, if a trader sets the slippage too high, another trader or bot can front-run the transaction. Note that not all crypto platforms enable traders to adjust their own slippage tolerance levels.

What Is Front-running?

Front-running happens when another trader, miner, or bot notices a trade set with a high slippage tolerance and forces the transaction to execute at the maximum slippage possible. This is an unnecessary loss for the trader because although the asset price remains within the trader's slippage tolerance, the execution happens at the worst possible price. The best way for traders to avoid front-running is to set their slippage tolerance relatively low and increase it as prices change.

Summary — Slippage and Crypto Trading

Slippage is a common occurrence in cryptocurrency trading. Although it can affect a trader's plan, it is not always bad. Regardless, all traders should note that in times of high volatility, slippage could generate a gain, or, much worse, a terrible loss.

Experienced traders should apply careful strategies to use slippage to their advantage by maximizing profits and minimizing losses on buy or sell orders. Other traders looking to reduce risks can use order limits, slippage tolerance, or trade with well-known crypto exchanges and DeFi platforms.

Trade P2P on AtomicDEX

AtomicDEX supports native cross-chain/cross-protocol trading for dozens of blockchain protocols and their crypto assets.

Use the built-in non-custodial wallet to HODL your crypto or trade crypto peer-to-peer (P2P) on the decentralized exchange.