15 August 2022

Updated: 19 October 2022

Compound Finance: How the DeFi Protocol Helps Users Lend, Borrow, and Earn Crypto

Table of contents

Table of contents

Decentralized finance (DeFi) is growing in popularity, as it addresses the limitations of conventional and established markets, as well as their participants.

DeFi protocols like Compound Finance provide market participants with new ways to save, trade, earn, and also use crypto assets with decentralized applications (DApps).

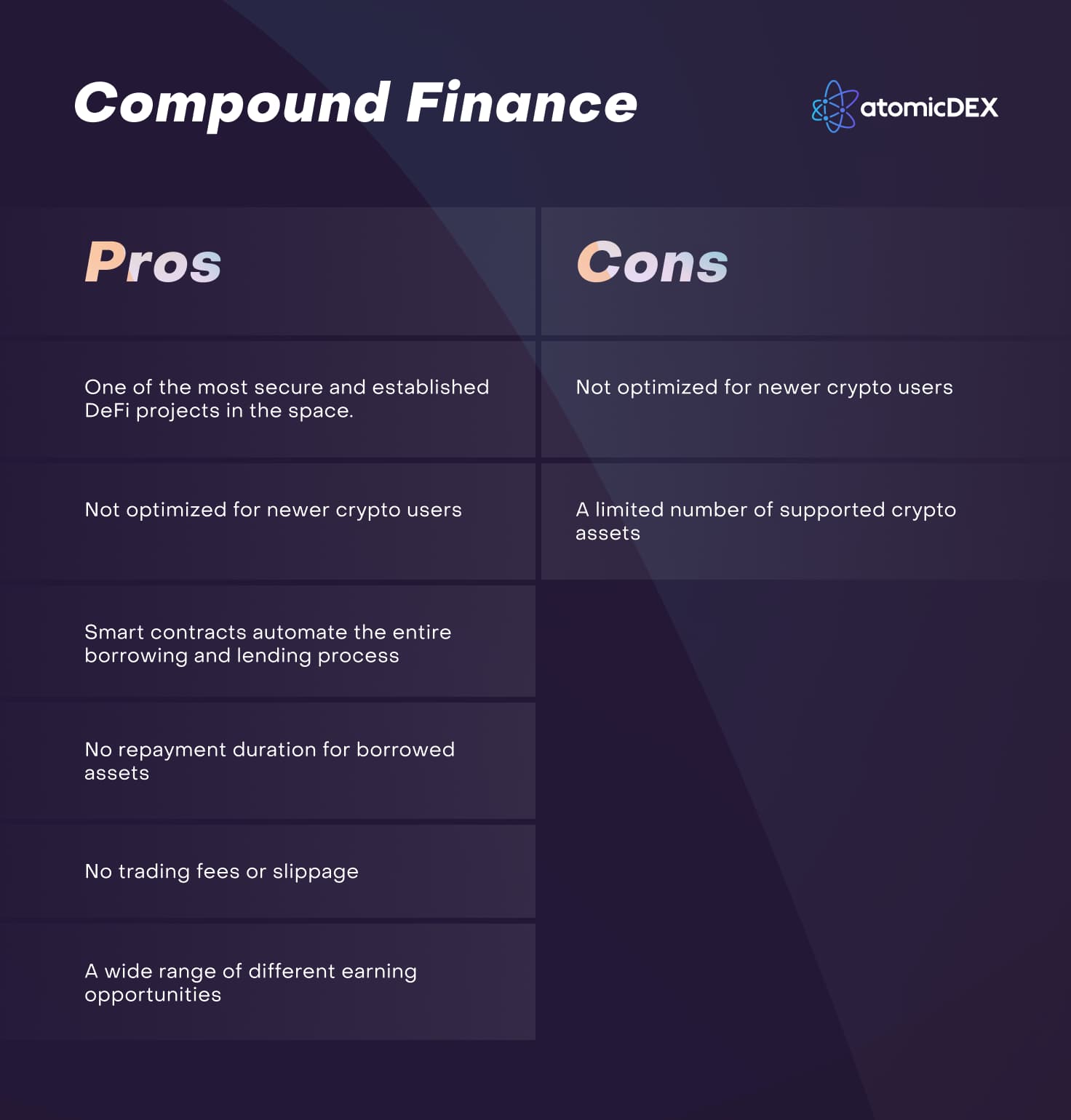

Compound Finance Pros and Cons

There are several pros and cons to using the Compound Finance platform. Some of these include:

What Is Compound Finance?

Compound Finance is a decentralized crypto lending and borrowing platform built on the Ethereum network. Individuals and institutions using the platform can earn interest on crypto assets they supply (lend) to the protocol's users. Users looking to borrow crypto assets can also do so directly from the protocol without third parties or counterparties mediating the transaction.

The Compound Finance protocol is an innovative DeFi project that builds on traditional financial money markets by employing a fully decentralized model. Traditionally, these types of applications would be reserved for bankers or well-established funds, but now, they are widely available to the masses. Participants can connect to the protocol using a Web 3.0 crypto wallet like MetaMask or a hardware wallet. Each user only needs an active internet connection and a compatible crypto wallet.

How Does Compound Finance Work?

Compound Finance works by using its native COMP token to tokenize assets locked on the platform. These COMP tokens (or cTokens) are ERC-20 tokens used to represent the value of user funds locked in the Compound Finance asset pool.

Lenders supply the pool with ERC-20 tokens such as ETH or DAI, and receive a corresponding amount of cTokens. Each user can redeem their deposited ERC-20 tokens later using cTokens, and also claim accrued interest from the deposit. Users should note that supply and demand for each asset largely determine the applicable interest rates.

Crypto Lending with Compound Finance

Users can deposit supported crypto assets on the Compound Finance protocol without third-party oversight or regulation. Locking funds in the protocol is similar to depositing funds in a traditional savings account (although with slightly more risk). However, instead of a bank account, Compound Finance sends the funds into a pool that contains similar assets and is powered by smart contracts. Each lender receives interest in their individual wallets based on their contributions to the pool.

Crypto Borrowing with Compound Finance

Borrowing crypto with Compound is a bit more complicated. Users who have locked funds in Compound Finance may borrow against their deposits. However, the amount of crypto assets a user locks in the protocol determines how much the user can borrow.

For instance, if a user locks in 1 ETH priced at $1500 and the protocol has set an 80% borrowing limit for ETH, the user can borrow any other supported crypto up to $1200. Like traditional banking loans, users must pay interest on borrowed crypto assets. Unlike traditional banks, which use credit stores, there is no standardized 'credit score' in the crypto space, so borrowing is currently based on the over-collateralization of assets.

Benefits of Using Compound Finance

In addition to accessing loans, Compound Finance also offers its users the following benefits:

- Compound Interest: Compound Finance is the ideal protocol for crypto users who wish to earn compound interest on their assets rather than simply holding them in their wallets.

- Ease of Use: The Compound Finance model encourages investing and allows users to freely move crypto assets without bottlenecks.

- Loan Duration: The protocol does not specify a time limit when borrowing crypto assets. However, users should note that interest payable on loans accumulates until the user repays the loan.

Risks of Using Compound Finance

Like any DeFi lending and borrowing protocol, using Compound Finance comes with certain inherent risks. Users should take note of the following before getting directly involved:

- Smart Contract Risk: There is always the chance that hackers can access and manipulate smart contracts for their selfish interests. Although Compound Finance's smart contracts have been vigorously audited to reduce this potential risk from malicious actors, it still has a non-zero chance of taking place.

- Impermanent Loss: Impermanent loss occurs when the value of funds locked in the liquidity falls below the price at the initial deposit.

- Volatile gas fees: The Compound Finance protocol uses the classic supply and demand mechanism to set gas fees. These fees typically rise when the market is active or saturated and drop when there is reduced activity.

Wrapping Up Compound Finance

Decentralizing the borrowing and lending process is necessary for providing alternative financial solutions to all who seek them. Since loans are a vital part of the financial industry, eliminating middlemen from the process will help with economic equality. On top of that, regular and everyday users will be able to fill the shoes of wealthy corporations, generating wealth for themselves instead of having it extracted by others.

The Compound Finance platform is a great way for lenders to generate passive income on crypto assets and has established its viability time and time again, even in the most volatile of crypto market conditions. It is also one of the leading protocols in the DeFi space, with many features experienced crypto users can enjoy. However, newer users without a solid knowledge base of the crypto market may find it challenging to navigate the protocol when they are just beginning.

HODL and Trade COMP on AtomicDEX

AtomicDEX is a non-custodial wallet, cross-chain/cross-protocol bridge, and cross-chain/cross-protocol DEX rolled into one app.

Interested users can download and set up an AtomicDEX wallet to HODL and trade COMP as well as any of the crypto assets supported on Compound Finance.